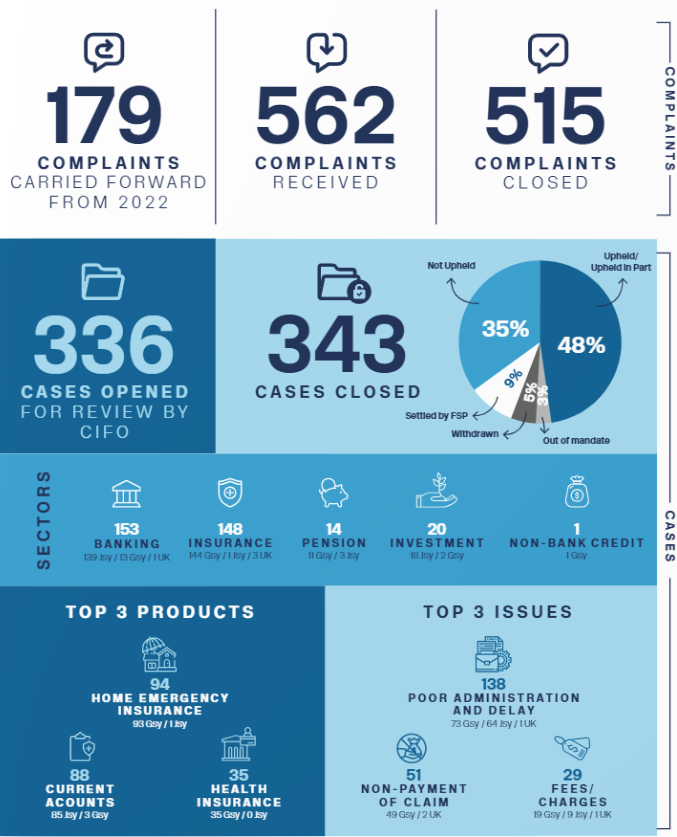

The Channel Islands Financial Ombudsman awarded more than £1.3 million in compensation last year to people who complained about their bank, insurer, investments or pension provider.

The office received 562 new complaints about financial services providers.

That is up 12% on the previous year.

The majority were about the banking or insurance sectors.

Common themes include accounts being blocked or closed, and low claims values for boiler repairs and damage to property.

In the office's annual report, principal ombudsman Douglas Melville has highlighted a growing issue with customer service among some firms:

“It is often heard that the standard of customer service offered by some businesses and bureaucracies has declined post-Covid.

“Our general experience of some local financial-services complaint-handling is no different. Complainants frequently tell us their concerns are not being treated as complaints by financial-services providers."

He says the customer's goodwill is often lost when an early resolution would have retained their confidence and taken less time.

He says many firms that are complained about miss the two-week deadline to respond to the ombudsman. The average wait is 31 says, which causes further delays investigating the grievance.

Cyber security law passed

Cyber security law passed

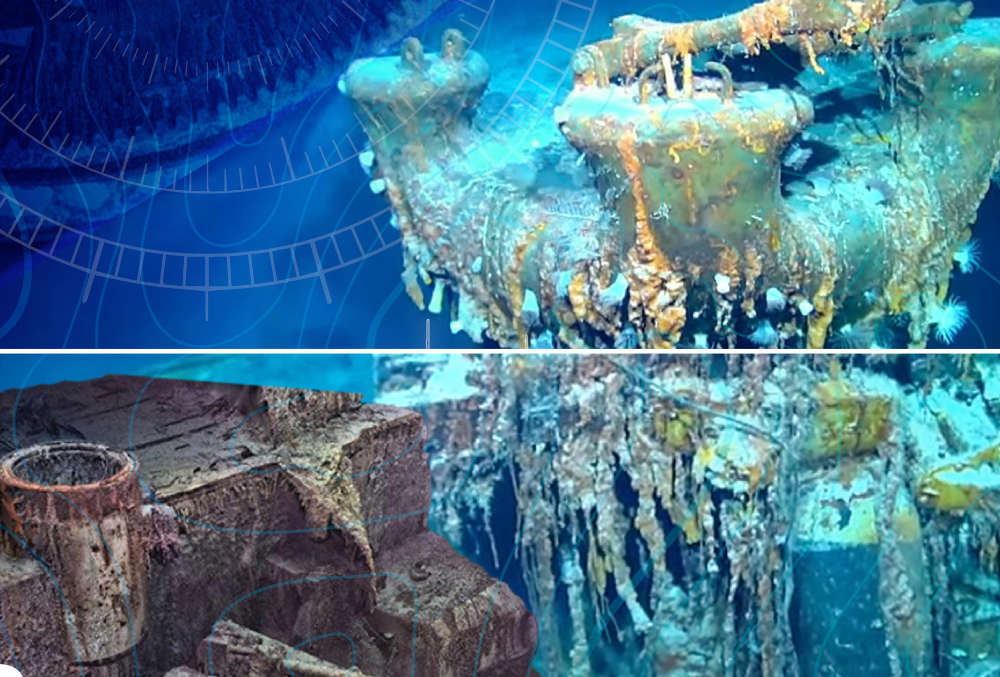

A 3D map of the battleship Bismarck is created by a Guernsey-based company

A 3D map of the battleship Bismarck is created by a Guernsey-based company

Ban on dogs in Springfield Park lifted

Ban on dogs in Springfield Park lifted

Channel Islands Air Search aircraft returns to service

Channel Islands Air Search aircraft returns to service

End-of-life care is changing in Jersey as politicians push forward assisted dying

End-of-life care is changing in Jersey as politicians push forward assisted dying

States agrees to tougher powers over Jersey's gas company

States agrees to tougher powers over Jersey's gas company

Driver 'critical' after crash in St Ouen

Driver 'critical' after crash in St Ouen

Government reverses decision to cut JET's funding

Government reverses decision to cut JET's funding